Taxact if My Tax Form Gets Rejected Do I Have to Pay Again

How to Correct an E-file Rejection

Eastward-filing has become the most pop way to file taxes because of the convenience and increased turnaround time it offers filers. It tin can besides reduce the number of errors in a filing. Part of the reason for this is that online revenue enhancement preparation software similar ours assists our customers through the process. The other role is that the IRS performs a preliminary review of each e-filing before accepting it. This preliminary review works to spot mutual errors and provide the individual the opportunity to fix them.

While an e-file rejection message is a bit nervus-racking the process for correcting and returning it is often non that hard at all. In fact, depending on the type of error and if information technology is a minor problem, y'all may be able to resubmit in a matter of minutes.

Taxpayers are provided 10 days (agenda not work week) to correct rejected returns. If yous are concerned about a notice received close to or after April 15th, do not worry. The IRS allows you until April 20th to correct an east-file rejection and resubmit it electronically.

Here is the procedure for correcting your e-file in case it is rejected:

Commencement determine the error. There are several different errors for which an e-file may exist returned, and with each the IRS will transmit a code to assistance determine what the error is. Annotation: if you are using our software programs there is no demand to look upwardly the code definition, nosotros will exercise that automatically for yous.

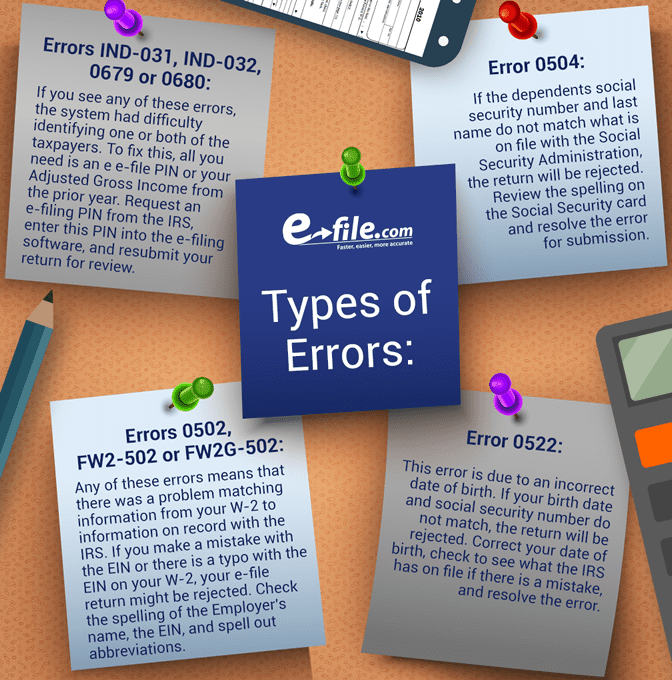

Here are a list of common error responses received on 1040 submissions:

* Errors IND-031, IND-032, 0679 or 0680

If you see any of these errors, the system had difficulty identifying one or both of the taxpayers. To prepare this, all you need is an e due east-file PIN or your Adjusted Gross Income from the prior year. Request an due east-filing Pin from the IRS, enter this Pin into the due east-filing software, and resubmit your return for review.

* Mistake 0504

This is a very common mistake when you lot are claiming a dependent. If the dependents social security number and terminal name exercise not match what is on file with the Social Security Assistants, the render will be rejected. Review the spelling on the Social Security bill of fare and resolve the mistake for submission.

* Errors 0502, FW2-502 or FW2G-502

Any of these errors means that there was a problem matching data from your W-2 to data on record with the IRS. If you make a fault with the EIN or there is a typo with the EIN on your West-2, your due east-file render might be rejected. Bank check the spelling of the Employer's name, the EIN, and spell out abbreviations. By fixing the employer'due south name and the EIN, yous can ready the e-file rejection and transmit your render once more.

* Error 0522

This fault is due to an incorrect engagement of nativity. If your birth date and Social Security number do not match, the return will be rejected. Correct your engagement of birth, cheque to see what the IRS has on file if in that location is a mistake, and resolve the error.

* Errors 0507 or R0000-507-01

If you are claiming a dependent and receive either of these errors, the Social Security number of the dependent has already been claimed. Check to meet if the Social Security number is correct, see if y'all take typed the number in twice, and contact the IRS (contact data can exist found here) to see who has claimed your dependent. If it was a mistake, fix the error. If the dependent has been claimed, remove the dependent from your due east-file and resubmit.

There are several different rejection errors you can encounter. The e-file software that you lot employ will requite yous a rejection report and explain what needs to be fixed earlier you tin can resubmit. Once you correct all of the errors, you can e-file once once more. If the rejection is due to information that the IRS has on file, you lot may demand to file a paper return until you can fix the mistakes that are leading to a mismatch.

In one case yous sympathise the mistake lawmaking, you can move forward onto fixing the problem and resubmitting the return. Most often these are clerical errors on disquisitional identifying information and every bit such they are rejected. In the rare occurrence that a return is not able to be stock-still and e-filed you will need to print your return and mail it in.

Source: https://www.e-file.com/help/correcting-rejected.php

0 Response to "Taxact if My Tax Form Gets Rejected Do I Have to Pay Again"

Post a Comment